Latest Blogs

View all

The Real Estate industry faces a unique architectural challenge today—not in the physical construction of buildings, but in the structural integrity of its financial data. The widespread use of Special Purpose Vehicles (SPVs) has created a landscape where financial oversight is drowning in structural complexity.

For modern real estate operators—whether in long-term leasing, development, or complex construction—the ability to consolidate figures quickly and accurately is the foundation of strategic control. Yet, many companies rely on outdated methods that lead to significant operational losses. This report explores the mechanisms behind these challenges, the "Amplification Effect" on audit costs, and how AI-native solutions like Corvenia represent a necessary evolution for the industry.

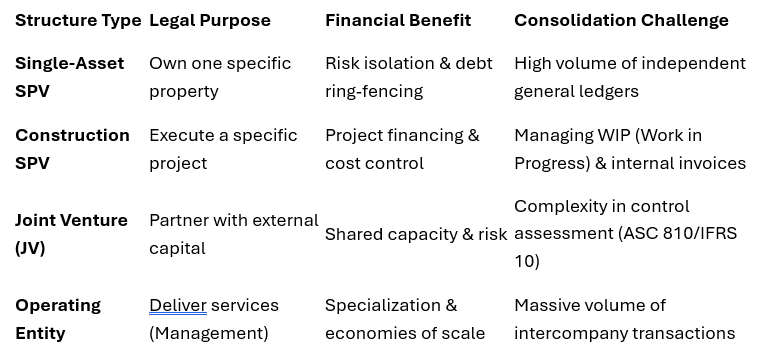

The use of SPVs is not arbitrary; it is a deliberate strategy for risk management and capital optimization rooted in the evolution of modern finance. In real estate, an SPV acts as a legally isolated entity owning a specific property or project, providing "bankruptcy-remote" protection for the parent company.

While the market for such structures is booming—projected to reach $20 billion by 2033—this isolation creates a paradox. It provides critical benefits: protection against lawsuits, tailored debt financing, and tax-efficient transactions. However, it also creates "Entity Sprawl. "As a group grows from ten to hundreds of SPVs, the administrative burden increases exponentially, not linearly.

Each of these entities often operates with its own bank account, chart of accounts, and sometimes disparate ERP systems, creating deep data silos that prevent a unified view of financial health.

The greatest barriers to effective consolidation in real estate are data fragmentation, the logistical nightmare of intercompany eliminations, and strict regulatory compliance.

A typical real estate group possesses financial data scattered across a patchwork of spreadsheets and disconnected property management systems. This fragmentation forces finance teams to spend weeks manually aggregating and validating data before the actual consolidation process can even begin. For cross-border operations, this is compounded by manual currency conversions, creating a high risk of error.

One of the most time-consuming tasks is the elimination of intercompany transactions to ensure the group accounts reflect only external economic activity. In real estate, this is uniquely challenging due to the tight links between Operating Companies (OpCo) and Property Companies (PropCo).

Common transactions include management fees, internal loans, and shared costs. Without automation, matching these manually is prone to errors caused by timing differences—e.g., Entity A books revenue in December, while Entity B books the cost in January. Resolving these discrepancies delays the closing cycle significantly.

Ineffective consolidation creates ripple effects that impact everything from daily operations to long-term valuation.

Traditional consolidation cycles are monthly. This results in the "29-Day Gap," where management makes decisions based on data that is up to 30 days old. In a volatile interest rate environment, this latency is critical. Management lacks the ability to detect margin drops, liquidity drains, or unexpected cost spikes in real-time.

Furthermore, Net Operating Income (NOI)—the key metric for real estate performance—is at risk. If costs are not captured intime, NOI is over-reported, potentially leading to incorrect valuations and covenant breaches.

There is a documented correlation between the complexity of group accounts and external audit costs, known as the "Amplification Effect". As the number of entities increases, auditors must spend more time verifying manual eliminations and data transfers. Without a "single source of truth," companies are forced to pay for extensive manual verification work.

To solve this, the industry requires a paradigm shift. Solutions like Corvenia replace static, batch-based methods with dynamic, intelligent orchestration. rather than forcing a painful migration toa single ERP, Corvenia acts as a layer above existing structures.

Corvenia ingests raw transaction data continuously from source systems, creating a "Unified Virtual Ledger." AI maps disparate charts of accounts to a group standard, eliminating manual standardization work. This shifts consolidation from a monthly event to a continuous process.

The platform automates the most demanding aspects of real estate finance:

For companies involved in development, consolidation is even more acute. Construction projects require strict control over WIP and project margins. When projects are organized in separate SPVs, getting a unified picture of exposure is difficult. Ineffective consolidation leads to budget overruns being detected too late for corrective action.

Real estate faces a strict regulatory environment. In Norway, for example, interest limitation rules (Tax Act § 6-41) are closely linked to the definition of a company within a group. Utilizing tax exemption soften requires line-by-line consolidation under standards like IFRS. Furthermore, the shift to IFRS and ESG reporting requires the consolidation of non-financial data (e.g., emissions) alongside financial data, a burden that manual systems cannot sustain.

The challenges of consolidating figures in the real estate industry are fundamental and deeply integrated into the SPV model. The traditional reliance on manual processes and spreadsheets has reached a breaking point where the costs—in terms of audit fees, lost decision power, and reduced investor trust—are too high to ignore.

For companies aiming to scale, the transition to AI-driven, continuous consolidation is no longer a choice, but a necessity. Corvenia offers a way out of the "29-Day Gap" by creating a seamless data layer that unites fragmented systems. By automating the technical aspects of consolidation, the finance function transforms from an administrative bottleneck into a strategic partner driving value creation.

Sources & References

1. Roundtable.eu: SpecialPurpose Vehicle: What is an SPV and Why it's usefulhttps://www.roundtable.eu/spv

2. Much Consulting: Odoo SPVguide | Set up and manage entities at scalehttps://muchconsulting.com/blog/odoo-2/odoo-spv-111

3. Domain6 Inc: Portfolio-widefinancial consolidation for real estate operatorshttps://domain6inc.com/portfolio-wide-financial-consolidation-for-real-estate-operators/

4. NetSuite: 15 Real EstateIndustry Challenges in 2025 https://www.netsuite.com/portal/resource/articles/erp/real-estate-industry-challenges.shtml

5. ERP Software Blog: Financialconsolidation for real estate operators and portfolio companieshttps://erpsoftwareblog.com/2025/09/financial-consolidation-for-real-estate-operators-and-portfolio-companies/

6. Madras Accountancy: RealEstate Consolidation Accounting: ASC 810 Guidehttps://madrasaccountancy.com/blog-posts/real-estate-consolidation-accounting-asc-810-guide

7. BrizoSystem: The CompleteGuide to Intercompany Eliminations in Consolidationhttps://brizosystem.com/blog/the-complete-guide-to-intercompany-eliminations-in-consolidation/

8. Reda.one: Multi-Entity RealEstate Portfolio Consolidation: Close Month-End in 5 Days Instead of 30https://www.reda.one/blog/multi-entity-real-estate-portfolio-consolidation-close-month-end-in-5-days-instead-of-30

9. EisnerAmper: From Fragmentedto Integrated: The Future of Real Estate Service Modelshttps://www.eisneramper.com/insights/real-estate/real-estate-service-models-0625/

10. Binary Stream: 7 commonfinancial consolidation challenges that companies face (with solutions)https://binarystream.com/7-common-financial-consolidation-challenges-that-companies-face-with-solutions/

11. Nominal: What AreIntercompany Eliminations and How to Automate Themhttps://www.nominal.so/blog/intercompany-eliminations

12. 24SevenOffice: Konsolidering | Regnskapsordbokhttps://24sevenoffice.com/no/regnskapsordbok/konsolidering

13. Visma: Eliminering av oppkjøp og merverdi i konsolideringved bruk av Periode & År for konsolidering av konsernregnskapethttps://kundeportal.vismasoftware.no/s/article/Eliminering-av-oppkj%C3%B8p-og-merverdi-i-konsolidering-ved-bruk-av-Periode-%C3%85r-for-konsolidering-av-konsernregnskapet?language=no

14. Corvenia: Unified VirtualLedger & AI-Native Consolidation https://www.corvenia.com/

15. The CEO's Right Hand: Howto Minimize Inefficiencies in Your Real Estate Businesshttps://theceosrighthand.co/real-estate-inefficiencies/

16. IDEAS/RePEc: An Empirical Study on the Influence of Consolidated Financial Statement’s Amplification Effect on Audit Fees https://ideas.repec.org/a/hin/jnddns/4691533.html

17. ResearchGate: An Empirical Study on the Influence of Consolidated Financial Statement's Amplification Effect on Audit Feeshttps://www.researchgate.net/publication/360637343_An_Empirical_Study_on_the_Influence_of_Consolidated_Financial_Statement's_Amplification_Effect_on_Audit_Fees

18. Prophix: What are the different consolidation methods? Pros, cons, and exampleshttps://www.prophix.com/blog/what-are-the-different-consolidation-methods-pros-cons-and-examples/

19. Skatteetaten: Rentebegrensningsregelen - konsolidering etterIFRS 5https://www.skatteetaten.no/rettskilder/type/uttalelser/prinsipputtalelser/rentebegrensningsregelen---konsolidering-etter-ifrs-5/

20. Norsk Regnskapsstiftelse: IFRS for SMEshttps://www.regnskapsstiftelsen.no/wp-content/uploads/2015/06/IFRS-SME-rapport-del-1.pdf

21.Gallagher Mohan: Year-End Accounting for Real Estate Companies: Key Challenges and Practical Solutionshttps://www.gallaghermohan.com/blogs/year-end-accounting-for-real-estate-companies-key-challenges-and-practical-solutions